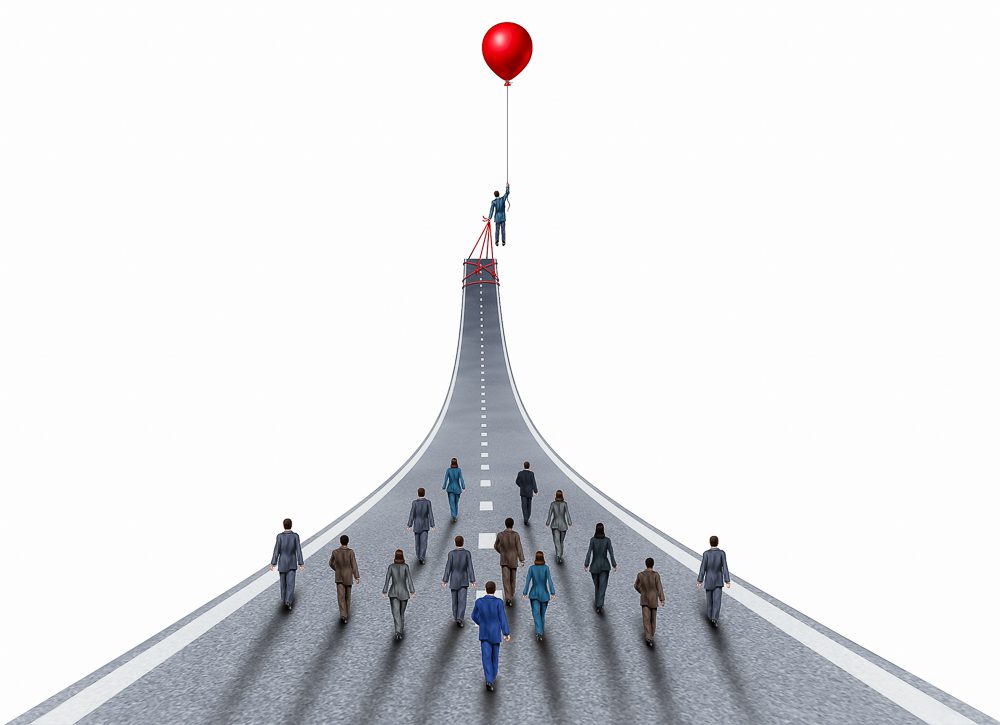

Get Ready for the Post-COVID-19 Business Reality

Accounting Brand Budgeting Business Management Cash flow Consulting Financial forecast Financing Leadership Legal Marketing Profit StrategiesDigital Transformation Post COVID-19 in the business world will see continued changes in digital transformation, DTC, platform model, brand building and digital marketing. Get Ready for the Post-COVID-19 Business Reality As more and more people are getting vaccinated in the US, and offices are starting to reopen beginning of this summer in 2021, it is […]

Read more ›