This article is based on the book “Profit First”, by Mike Michalowicz, and a presentation by Gabriel Dutari about applying the Profit First principles (https://www.youtube.com/watch?v=a1XzaaJBmRQ&feature=youtu.be)

About 99% new businesses are started not by financial experts, but by specialists or technicians such as engineers, architects, lawyers, chefs, artists, who are very good at what they do, but not at corporate finance, financial administration and leadership.

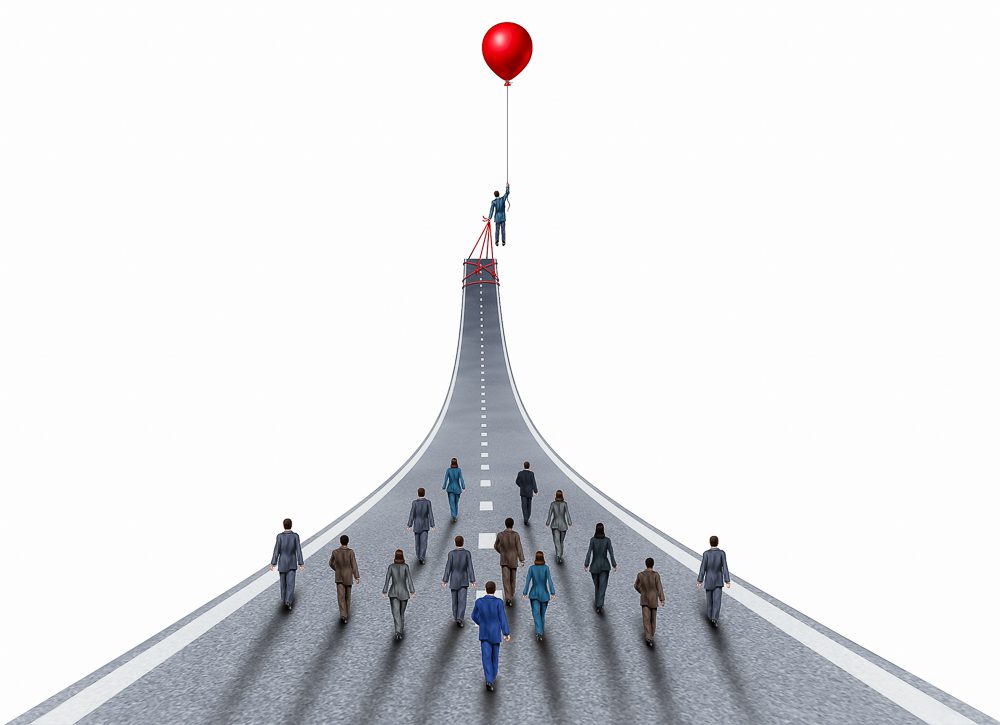

Traditional way of thinking about profit can lead to cash crunch

Almost 96% of these businesses won’t make it to the 10th year, because these specialists don’t know how to turn profits into cash, which leads to cash flow problems. “Profit First” addressed this problem by first challenging the usual formula for arriving at profit:

Revenue – expense = profit. However, this formula does NOT work because:

First, the “Parkinson’s Law”:

- When a resource is available (e.g. money in the bank), humans tend to use all of it.

- Human behaviors change when there is less resource available.

- We become more prudent, creative and find ways to get the most out of it.

Second: Decision-making with online banking:

As many as 99% of business owners don’t make day to day purchasing decisions based on financial statements. If there is money in the bank, they buy. Since all their money is in one pot/account, they cannot tell if they are overspending to the detriment of business operations. They tend to spend the money whenever they see it in their bank account, from the mental habit of “since I have it, I will spend it.”

Reversing the formula and keeping separate accounts

By changing the traditional way of arriving at profit LAST, into the “Profit First” formula, i.e. Revenue – profit = expense, business owners first take out whatever the amount of profit a company decides to be, and put it “out of sight, out of mind” into a separate account, then the business has to adjust to whatever operating budget is left. This new habit forces the business owner to be more prudent, creative, and more resourceful to economize the last drop of the resource.

“Profit First” separates money into different bank accounts with different purposes, so you can see what each dollar is for. It helps assign different duties to each dollar.

For example, if a construction company won a bid of $2 million dollars, its total revenue is not $2 million dollars after deducting all the expenses for materials, payment to subcontractors, taxes, operating expenses and owner’s compensation. First, the company needs to designate a percentage for profit, say 15%, into a separate bank account. Second, put taxes (say 15%) in another bank account, then put all other operating expenses (50% +-) into a third bank account, after which put owner’s compensation (15 – 45%) into a fourth one.

Redefine “profits”

Instead of calling profits as whatever amount left after paying everyone and everything at the end of the year, profits are the rewards for the owners, shareholders, or investors who took the risks. Profits should not be used to finance operations.

It takes both financial expertise and fiscal discipline to do this. If business owners are not financial experts, it is not easy to see if profits are converted into cash.

Profit is not an event, it is a HABIT!

Implementing “Profit First” principles

Business owners need to take these steps to live the Profit First habit:

- Evaluating your business using the “Profit First” methodology

- Compare yourself to other financially healthy companies

- Set Goals and take actions to restructure your business

First, determine what percentage of the REAL revenue (after deducting costs for materials and labor) goes to owner’s compensation, business operations, taxes. Secondly, compare with other financially healthy companies, by googling the KPIs of similar companies like yours, to know where you are and where you want to be. Then have a plan to get from Point A to Point B, by taking small incremental steps, every quarter, to reach your goals of increasing profit while lowering expenses.

During COVID, while revenue is declining, Parkinson’s Law is making many owners get the most bang for their shrinking operating budget, to avoid using profit and owner’s compensation to subsidize operation.

A2zCFO, both the Right and Left Arms for your organization:

A2ZCFO takes pride in helping small business owners prepare for either storms or calm weather, and navigate safely through rough waters. As a consulting CFO, I help business owners and management to “keep your ship on course.”

We help with any aspect of financial management from A to Z. By providing trusted financial advice, I create financial and goal clarity, resulting in increases in cash, profitability and sales all the while preparing the business strategically for a successful exit when the time is right.

- Works at client’s location and directly with client’s staff;

- Affordable and flexibility in hours – 4 hours a month to short term full time assignment;

- Excels at messy and difficult clean up situations;

- Meaningful financial reporting for management, bankers, and CPA’s. Tax returns completed by due dates;

- Cradle to grave services – from bootstrapped startups to exit transition service experience.

Please call me (925) 216-5058 or email: rolf@a2zCFO.com

A2Z CFO, we keep your ship on course.