Occupational, Internal and Employee Fraud- how to detect and prevent it (Part 2 of 2)

Accounting Asset misappropriation Corruption Ethics & Fraud Fraud prevention Legal StrategiesOccupational fraud prevention & detection require a company to set up a reporting system, implement internal controls, & engage employees. In Part 1, we talked about three types of fraud, and the “fraud triangle”. In Part 2 we will discuss fraud prevention and detection to reduce losses. Preventing fraud is much easier and less costly […]

Read more ›Occupational, Internal & Employee Fraud – What & Why (Part 1 of 2)

Accounting Asset misappropriation Business Management Corruption Ethics & Fraud Fraud prevention IncentiveInternal fraud is a universal and an “evergreen” problem across all industries and cultures. Failure of ethics and the struggles therewith are just part of human nature. A typical organization loses about 5% of its annual revenue each year due to employee fraud (2014 Report to the Nation on Occupational Fraud and Abuse, by the […]

Read more ›Get Ready for the Post-COVID-19 Business Reality

Accounting Brand Budgeting Business Management Cash flow Consulting Financial forecast Financing Leadership Legal Marketing Profit StrategiesDigital Transformation Post COVID-19 in the business world will see continued changes in digital transformation, DTC, platform model, brand building and digital marketing. Get Ready for the Post-COVID-19 Business Reality As more and more people are getting vaccinated in the US, and offices are starting to reopen beginning of this summer in 2021, it is […]

Read more ›Deductible Expenses with PPP Loans & the 2nd Round of PPP Loans

Business Management Debt & Loan Management Loans PPP loans and forgiveness Strategies TaxesThe US Congress rules that expenses covered by PPP loans are tax-deductible; second round of PPP loans have simplified application for loans under $150k. Expenses With PPP Money Are Tax Deductible Out of the window now: all IRS rules about not allowing deducting expenses with Paycheck Protection Program (PPP) loans on tax returns. New rules […]

Read more ›Apply Non-deductible Business Expenses Related to PPP Loans in 2020 Taxes

Accounting Financial Statements Loans PPP loans and forgivenessThe IRS rules that payroll and business expenses that PPP loans helped to cover in 2020 are not deductible in determining 2020 business taxes. For businesses that took out PPP loans in spring 2020, the IRS does not allow “double dipping” by deducting business expenses associated with the forgivable portions of your PPP loan, as […]

Read more ›PPP Loans Affect 2020 Business Taxes

Accounting CFO Debt & Loan Management Loans TaxesThough the forgiven portion of a PPP loan is non-taxable, taxable income is also higher since payroll and other expenses are not deductible. The US Federal government doled out more than $500 billion forgivable PPP loans under the CARES Act to small businesses in order to help keep employees on payroll and pay for rent […]

Read more ›Revenue – Profit = Expense: Use “Profit First” Principles for Businesses During COVID19 and After

Accounting Budgeting Business Management Cash flow CFO Consulting Financial forecast Financial Statements ProfitThis article is based on the book “Profit First”, by Mike Michalowicz, and a presentation by Gabriel Dutari about applying the Profit First principles (https://www.youtube.com/watch?v=a1XzaaJBmRQ&feature=youtu.be) About 99% new businesses are started not by financial experts, but by specialists or technicians such as engineers, architects, lawyers, chefs, artists, who are very good at what they do, […]

Read more ›Budgeting and Financial Forecasting During COVID-19

Budgeting Business Management Cash flow Financial forecastCOVID-19 is changing the macroeconomic climates as well as impacting individual entities. Your annual, quarterly and monthly budgets and financial forecast during this uncertain time has become a moving target, as the economy shuts down, reopens, and recovers. Since April, 2020, we have experienced business shutdown, PPP and EIDL loans, and undoubtedly more uncertainties for […]

Read more ›A Cloud-based system can improve accounting operation

Accounting Budgeting Business Management CFO Financial forecast Financial StatementsCovid-19 has forced many businesses to conduct daily operations online, including accounting and finance. A cloud based system can improve collaboration and efficiencies in financial and accounting consolidation, reporting and teamwork. There are different types of subscription-based Software as a Service (SaaS) for accounting, such as QuickBooks Online, SlickPie, Sage 50, Zero and Kashoo. A […]

Read more ›PPP Loans’ New & Better Terms, – 6 days left to apply!

Cash flow Debt & Loan Management Financing LoansThe Paycheck Protection Program (PPP) loan program is scheduled to end June 30, 2020. The new PPP legislation has changed the Paycheck Protection Program Loan to make it easier to qualify for forgiveness up to 100%: You now have up to a 24-week Covered Period (previously 8 weeks) to spend loan funds starting the date […]

Read more ›Time to re-assess your company’s financial health

Accounting Business Management Cash flow CFO Debt & Loan Management Financial forecast Financial Statements StrategiesAs our economy is going through dramatic changes due to Covid-19, it is time to re-examine your company’s balance sheet and income statement to make adjustments or even changes in direction in order to survive and thrive. This article addresses what you need to do in this regard, following my last blog where I talked […]

Read more ›A Crisis Calls for Changing Financial Budget and Business Plans

Accounting Budgeting Business Management Cash flow Debt & Loan Management Financial forecast Financing StrategiesThe world today is very different than it was 6 weeks ago. Before the Covid-19 lockdown, the U.S. economy was strong, the bull market was high, and unemployment was low. As our economy is slowly and gradually opening up, we are facing unprecedented unemployment, business closures, large numbers of people working from home, and many […]

Read more ›Customer Lifetime Value (CLV) and CLV to CAC Ratio – Part 2 of 2

Accounting Business Management Consulting Financial forecast Marketing Startups StrategiesIn Part 1, we discussed CAC (customer acquisition cost), how to use it and its limitations. In Part 2 here, we will explain about CLV and CLV to CAC ratio. CLV – Customer Lifetime Value CLV (sometimes referred to as LTV) represents the total amount of revenue a business gets from a customer over the […]

Read more ›Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLV) – Part 1 of 2

Accounting Budgeting Business Management CFO Financial forecast Profit margin StrategiesThe CAC metric and other related metrics of CLV and CLV to CAC ratio are used to measure companies’ internal operation and investment in marketing and sales, as well as by investors to assess scalability of recurring revenue business models, especially fast growing internet companies such as subscription-based SaaS companies and e-commerce, web-driven businesses. The […]

Read more ›Annual Budgets

Accounting Budgeting Business Management Cash flow CFO Consulting Financial forecast StrategiesAs 2020 is unfolding, businesses are budgeting for the entire year. The budget process is more than predicting costs and profits. It is about planning ahead for all scenarios in case sales goals go up, down or remain the same. The importance of having an annual budget Careful budgeting gives a realistic picture about how […]

Read more ›2019 Federal and CA Tax Information at a Glance

Accounting CFO Consulting Strategies TaxesHappy Holidays from a2zCFO and Rolf Neuweiler, Principal consulting CFO. Please make use of this Federal and CA Tax Information. As 2019 is drawing to a close, I hope the attached “Fast Tax Facts” with both Federal and CA tax information at a glance, – thanks to CalCPA, will make your tax preparation a little […]

Read more ›Fraud Detection and Prevention – Part 2 of 2

Accounting Business Management CFO Consulting Fraud preventionIn July 2019, in Part 1, we discussed about detection of internal fraud and employee theft in a company. In Part 2 here we are discussing about ways for fraud prevention. Internal fraud and employee theft in a workplace can be catastrophic to any company, it can be life threatening to a small business with […]

Read more ›The Seven Signs of Ethical Collapse: How To Spot Moral Meltdowns in Organizations

Accounting Brand Business Management Fraud prevention Legal StrategiesIn the book “The Seven Signs of Ethical Collapse” by Marianne Jennings, JD., these seven signs are listed for spotting an organization’s ethics crisis that can bring down corporations like Enron and other businesses and nonprofits: Pressure to maintain the business numbers Culture of fear and silence A “bigger than life” CEO and awe-struck direct […]

Read more ›Revenue and Profit Margins

Accounting Business Management Cash flow CFO Consulting Financial forecast Financial Statements Profit marginIn our last blog, we talked about EBITDA and EBITDA margin, and stated that it is better to use both GAAP metrics and EBITDA to determine an organization’s financial health. Under the guidelines of GAAP (generally accepted accounting principles) requirements for corporate accounting, a profit margin is calculated using one of the three principles: gross […]

Read more ›EBITDA

Accounting Business Management Cash flow CFO Consulting Financial forecast Financial Statements Profit margin StrategiesWhat is EBITDA? EBITDA is the abbreviation for “Earnings Before Interest, Taxes, Depreciation and Amortization.” It is a measure of overall profitability of a business. How are EBITDA and EBITA margin calculated? EBITA = earnings before interest, taxes, depreciation, and amortization. EBITDA margin = EBITDA divided by total revenue. EBITDA and EBITDA margin help determine […]

Read more ›Fraud Detection and Prevention – Part 1 of 2

Accounting Business Management CFO Fraud preventionInternal fraud by employees in a workplace can be catastrophic to any company, it can be life-threatening to a small business with limited resources. In Part 1, we will discuss about employee theft and fraud audit detection. Next month in Part 2 we will address prevention issues. Who steals from employers? According to the shocking […]

Read more ›Tips for social security claims benefits

Accounting Budgeting Consulting Financing Social Security StrategiesWait until full retirement age will maximize benefits amount The general rule of thumb is that if you postpone taking social security benefits until after your full retirement age, you will receive a higher monthly benefit. But after reaching full retirement age, there is no more gain from delaying claims. Remember, the earliest a person […]

Read more ›Old and New Scams for Stealing Identity in Today’s Digital Age

Business Management Financial Statements Fraud prevention StrategiesEvery day we get calls and receive emails from unknown sources and spammers. The following are not exhaustive lists of scams, as identity thieves are “evolving” with more sophisticated ways to breach cyber security. Here are the top 10 scams from Consumer Reports: Debt collection Fake government officials – IRS, Social Security, State Department, etc. […]

Read more ›IRS Impersonators and Scams Related to Tax Returns

Accounting Business Management Consulting Fraud prevention TaxesMany people reported that they have received IRS impersonators’ calls, and sadly some fell victims of various scam schemes after being intimidated into paying a fabricated tax bill. Thousands of people have lost millions of dollars and their personal information to tax scams. Scammers use the regular mail, telephone, or email to set up individuals, […]

Read more ›Lafayette Professionals Group Meeting May 1st, 2019, 5:30pm

UncategorizedOne thing is certain … CHANGE! Change is always happening; but now with more velocity than ever. We invite you to learn about changes in the law, fraud protection and the local and national economy at a presentation hosted by Mechanics Bank and Lafayette Professionals Group. Changes Join us at Mechanics Bank, 3640 Mt. Diablo […]

Read more ›Part 2 of 2: FINANCIAL & MANAGEMENT PITFALLS FOR A GROWING SMALL BUSINESS

Brand Budgeting Business Management CFO Consulting Financial forecast Insurance Legal Strategies TaxesIn January 2019, I talked about financial and management pitfalls for growing small businesses at a professional networking group meeting. Last month in Part 1 of the two parts, we first focused on potential pitfalls related to lacking strategic goals and skills. Here in Part 2 I am listing some pitfalls related to leadership, internal […]

Read more ›Financial and Management Pitfalls for a Growing Small Business – Part 1 of 2

Accounting Budgeting Business Management Cash flow CFO Consulting Debt & Loan Management Financial forecast Financial Statements Financing Line of credit Loans Profit margin Strategies TaxesPart 1 of 2: PITFALLS FOR A GROWING SMALL BUSINESS In January 2019, I talked about financial and management pitfalls for growing small businesses at a professional networking group meeting. Here in Part 1 of the two parts, we first focus on each potential pitfall related to lacking strategic goals and skills. In Part 2 […]

Read more ›Cash Flow Problems and Solutions for Startups and Small Businesses (3rd of 3 parts)

Accounting Budgeting Business Management Cash flow CFO Consulting Debt & Loan Management Financial forecast Financing Line of credit Loans Profit margin StrategiesThis is the last of three parts about cash flow problems and solutions for small businesses. In Parts 1 and Part 2, we discussed seven preventive strategies for all businesses: 1.) Get accounting books organized. 2.) Use a cash-flow budget. 3.) Get customers to pay quickly. 4.) Rein-in unnecessary spending and stay alert to potential […]

Read more ›Cash Flow Problems and Solutions for Startups and Small Businesses (2nd of 3 parts)

Accounting Budgeting Business Management Cash flow CFO Consulting Debt & Loan Management Financial forecast Profit margin StrategiesThis is the second of three blogs about cash flow problems and solutions, particularly relevant to startups, and also for small businesses. In Part 1, we discussed the first three of seven preventive strategies for all businesses: 1.) Get accounting books organized. 2.) Use a cash-flow budget. 3.) Get customers to pay quickly. Here in […]

Read more ›Cash Flow Problems and Solutions for Startups and Small Businesses (1st of 3 parts)

Accounting Budgeting Business Management Cash flow CFO Consulting Financial forecast Profit margin StrategiesThis is the first of three blogs about cash flow problems and solutions for small businesses. Cash flow management is key for a small business to succeed About 82 percent of startups and small businesses fail due to poor cash flow management. Businesses experience cash flow problems when they cannot timely pay employee salaries and/or […]

Read more ›Common Accounting Pitfalls for Small Businesses

Accounting Budgeting Business Management Cash flow CFO Debt & Loan Management Financial forecast Profit margin StrategiesCommon Accounting Pitfalls & Solutions for Small Businesses About 28 percent of companies go bankrupt due to problems with a company’s financial structure, according to a study undertaken by the Small Business Administration. Good bookkeeping and accounting practices not only can avoid many problems to make it easy for tax filings, new loans, and pitching […]

Read more ›Personal financial budgeting

Accounting Budgeting Consulting Credit history Financial Statements Strategies Taxes UncategorizedWe all have heard these: “Money doesn’t grow on trees.” “Save money for a rainy day.” “Failing to plan is planning to fail.” However, about ⅔ of Americans do not budget. Many live paycheck to paycheck. Financial stress often spills into relationships and family life. Budgeting is about intentional spending and mindful living. Budgeting […]

Read more ›Three Types of Budgeting for Businesses

Accounting Budgeting Business Management CFO Consulting Financial Statements StrategiesFailing to plan is planning to fail, that is why budgeting can help a business achieve financial success, predict profitability, provide a model for performance, formulate plans and strategies, and forecast income and expenditures. Planning and Forecasting A budget provides insight into a company’s financial position for the near future. A budget is a tool […]

Read more ›New Tax Law – Are “Meals” and “Entertainment” Still Deductible?

Accounting Business Management CFO Consulting Financial Statements Strategies Taxes UncategorizedIn the tax reform bill Congress approved last December, entertainment, amusement, or recreation or any expenses with respect to such a facility do not qualify for a tax deduction. Where does this leave “meals”? I have received many questions asking if meals are still deductible. Companies’ Holiday Parties: 100% Deductible Employee Only / Holiday Parties […]

Read more ›CFOs & CPAs Work in Synergy to Optimize Tax Strategies and Savings

Accounting Business Management CFO Consulting Strategies Taxes UncategorizedMaximizing tax savings for a company and its owner requires teamwork between both its CFO and CPA, each contributing different perspectives, skills, and functions. However, many business owners believe that they do not need a Chief Financial Officer (CFO) when they have a tax CPA. There is good reason for this confusion as some CFOs […]

Read more ›How to Convert Accounting Systems Successfully – Steps, Precautions, and Preparation

Accounting Business Management CFO Consulting UncategorizedAs with all business systems, accounting software and systems become outdated and inappropriate for a company’s growing needs. There is always a great deal of excitement and anxiety when implementing a new accounting package. Throughout my career I have been involved with many system conversions. Time and time again these conversions often seem to be […]

Read more ›Why do companies need timely and accurate financial statements

Business Management Consulting Financial Statements TaxesWhy do companies need timely and accurate financial statements? CEOs and business owners need to be always in the know about cash flow, sales growth, profit margin changes, and administrative costs. Managing a business requires its leaders to be constantly monitoring its “vital signs”. Financial Statements consist of Balance Sheet, Income Statement, and Statement of […]

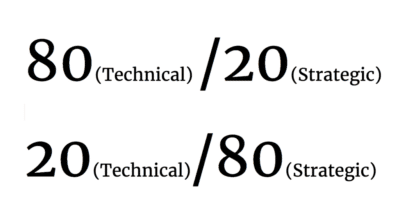

Read more ›Technical vs. Strategic CFO

ConsultingTechnical vs. Strategic CFO: From 80-20 to 20-80 Stage One: 80-20: Technical CFO, 80%: In the beginning, a technical CFO acts as a “financial fireman” due to messy books, audit, late payment, and other sorts of glitches and failures in a company’s financial system. About 80% of the service is putting house in order, like […]

Read more ›Birth of A2ZCFO

Consulting Debt & Loan ManagementAnnouncing the birth of a2z CFO! With great pride, delight, and gratitude, I am introducing you to a2z CFO, a consulting CFO firm serving small to medium sized businesses, family offices, and non-profit organizations. I am Rolf Neuweiler, founder and principal consultant. With 30 years of financial experience, including Chief Financial Officer and Controller responsibilities, […]

Read more ›Controller vs. CFO: An “Eye”on the Past, and the “Brain” for the Future

ConsultingFor a large organization, a Chief Financial Officer (CFO) is a full-time financial leader, working side by side with its CEO. Think of a CFO as a “co-pilot”, and a CEO as the “captain” of a passenger airplane. They both focus their brains and eyes on moving the plane forward to its destination. A controller […]

Read more ›You saved the sales taxes on your recent business purchase. Are you sure? You may owe Use Tax!

TaxesIn today’s electronic shopping world, businesses can purchase goods with a click of a button. Many times, items are purchased from out of state vendors, thru the internet, or under sales tax exemption certificates resulting in the vendor NOT collecting sales tax. However, with the concept of use taxes, you still may owe taxes to […]

Read more ›